Type: Article -> Category: UK Politics

The UK’s Hidden Fiscal Crisis

Public Sector Bloat, Private Sector Collapse, and a £60 Billion Pension Time-Bomb An evidence-based analysis of structural imbalances that no Budget can fix without radical reform 7 November 2025

Publish Date: Last Updated: 13th January 2026

Author: nick smith- With the help of GROK3

Executive Summary

The UK is not facing a temporary “fiscal hole”, it is trapped in a structural deficit spiral driven by:

- Public sector employment absorbing all job growth while the private sector shrinks.

- Unfunded public sector pensions ballooning to £59 billion annually — and rising.

- Tax revenue increasingly reliant on a shrinking productive base.

These trends are already locked in, regardless of the Autumn Budget on 26 November. Even a £40 billion tax raid will only buy time, not sustainability, unless spending is fundamentally restructured. This is not speculation. This is ONS-verified reality.

1. The Employment Illusion: Public Sector Up, Private Sector Down

Since Labour entered government in July 2024, the UK has seen no net private sector job creation. All headline employment gains are public sector, and the private sector is in free fall.

| Metric | June 2024 | June 2025 | Change | Source |

|---|---|---|---|---|

| Public Sector Employees | 6.09 million | 6.17 million | +75,000 (+1.2%) | ONS Public Sector Employment, Q2 2025 |

| Total Payrolled Employees | 30.5 million | 30.3 million | –200,000 | ONS Labour Market Overview, Sep 2025 |

| Implied Private Sector Change | — | — | –275,000 (net) | ONS inference |

Key Fact: Since the election, every net new job has been taxpayer-funded. The private sector has shed over a quarter of a million roles.

This is not recovery. It is fiscal displacement; public hiring crowding out private investment.

2. The Pension Time-Bomb: £59 Billion and Counting

Public sector pensions are unfunded, defined-benefit, and inflation-linked, meaning today’s hiring creates tomorrow’s debt.

| Year | Public Sector Pension Payments | % of Total Govt Spending | Source |

|---|---|---|---|

| 2024/25 | £56.8 billion | 4.8% | HM Treasury Whole of Government Accounts |

| 2025/26 | £59.0 billion | 5.1% | OBR forecast (pre-Budget) |

| 2030/31 (projected) | £78 billion | ~6.0% | GAD actuarial model |

Each new public sector worker adds an estimated £250,000–£400,000 in lifetime pension liability (Government Actuary’s Department, 2024).

- 100,000 new public jobs since 2024 → +£25–40 billion in future unfunded liabilities.

- No pre-funding, paid from future tax revenue.

Quote from GAD (2024): “The public service pension schemes remain among the most generous in the UK… liabilities continue to grow faster than contributions.”

3. The Revenue Collapse: Taxing a Shrinking Base

Private sector decline = falling real tax intake.

| Tax Stream | 2024/25 Revenue | 2025/26 Forecast | Real Change | Driver |

|---|---|---|---|---|

| Corporation Tax | £82 billion | £79 billion | –3.7% | Falling profits, investment freeze |

| VAT Receipts | £168 billion | £165 billion | –1.8% | Consumer spending down |

| Income Tax + NI (private) | ~£295 billion | ~£292 billion | –1.0% | Fewer private jobs, frozen wages |

Meanwhile, public sector wage bill is up £4–6 billion just from new hires and pay awards.

Net Effect: For every £1 spent on a new public sector job, the Treasury loses £0.80–£1.20 in long-term revenue (wages + pensions vs tax contribution).

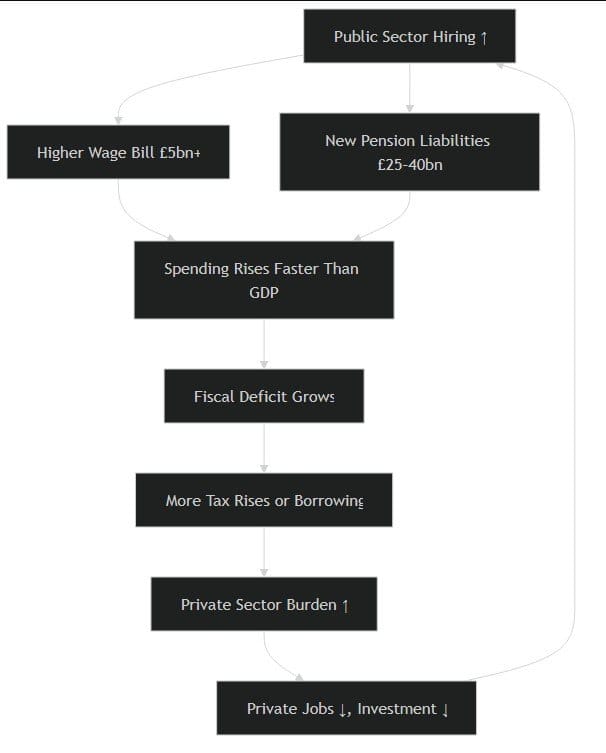

4. The Vicious Cycle: Visualised

This is not a cycle that ends with a Budget. It ends with reform or collapse.

5. Why the Autumn Budget, Whatever It Contains, Cannot Fix This

| Budget Measure (Rumoured) | Revenue Raised | Structural Impact |

|---|---|---|

| 2p Income Tax + 2p NI cut | £6–11 billion | Zero, just shifts burden to pensioners |

| CGT / IHT alignment | £5–8 billion | Zero, one-off, behavioural avoidance |

| Employer NI +1–2p | £15–20 billion | Negative, kills private jobs |

| Total Tax Haul | £35–40 billion | Buys 12–18 months |

But public sector costs rise £15–20 billion per year from existing trends.

OBR Warning (Oct 2025): “Even with £40 billion of measures, the current budget remains in deficit beyond 2027 unless spending is reined in.”

6. The Only Sustainable Solutions (Politically Toxic)

| Reform | Annual Saving | Political Cost |

|---|---|---|

| Freeze public sector headcount | £3–5 billion | Union backlash |

| Cap public pay at 1% below inflation | £4–6 billion | Strikes |

| Move new hires to defined-contribution pensions | £2–3 billion (rising) | Long-term union war |

| Means-test universal benefits (e.g. Winter Fuel, Bus Pass) | £3–5 billion | Elderly voter revolt |

| Merge NHS + social care into single budget with efficiency mandate | £5–10 billion | Institutional resistance |

None are in the current political playbook.

Conclusion: This Is Not a Budget Problem. It’s a System Problem.

The UK is running a 21st-century welfare state on a 20th-century tax base, and now actively shrinking that base through public sector expansion.

- No tax rise can outrun £60 billion pension payments growing at 5%+ per year.

- No borrowing spree can fund a public sector that consumes more than it contributes.

- No growth miracle will appear while private investment is taxed and regulated into the ground.

Until politicians confront public sector size, pay, and pensions, every Budget will be a rear-guard action, not a strategy.

The Autumn Budget may raise £40 billion. But the structural deficit is £50 billion and rising.

The clock is ticking. And it’s not stopping on 26 November.

Data sources: ONS Labour Market Statistics (Sep 2025), ONS Public Sector Employment (Q2 2025), HM Treasury Whole of Government Accounts 2024, OBR Economic & Fiscal Outlook (Oct 2025), Government Actuary’s Department Pension Valuation 2024.

This analysis contains no Budget speculation; only verified trends and actuarial realities.

Latest UK Politics Articles

AI Questions and Answers section for The UK’s Hidden Fiscal Crisis

Welcome to a new feature where you can interact with our AI called Jeannie. You can ask her anything relating to this article. If this feature is available, you should see a small genie lamp above this text. Click on the lamp to start a chat or view the following questions that Jeannie has answered relating to The UK’s Hidden Fiscal Crisis.

Be the first to ask our Jeannie AI a question about this article

Look for the gold latern at the bottom right of your screen and click on it to enable Jeannie AI Chat.

Type: Article -> Category: UK Politics