Type: Article -> Category: AI Business

A Bitter Pill to Swallow: The Perils of Owning a Business

Publish Date: Last Updated: 4th January 2026

Author: nick smith- With the help of CHATGPT

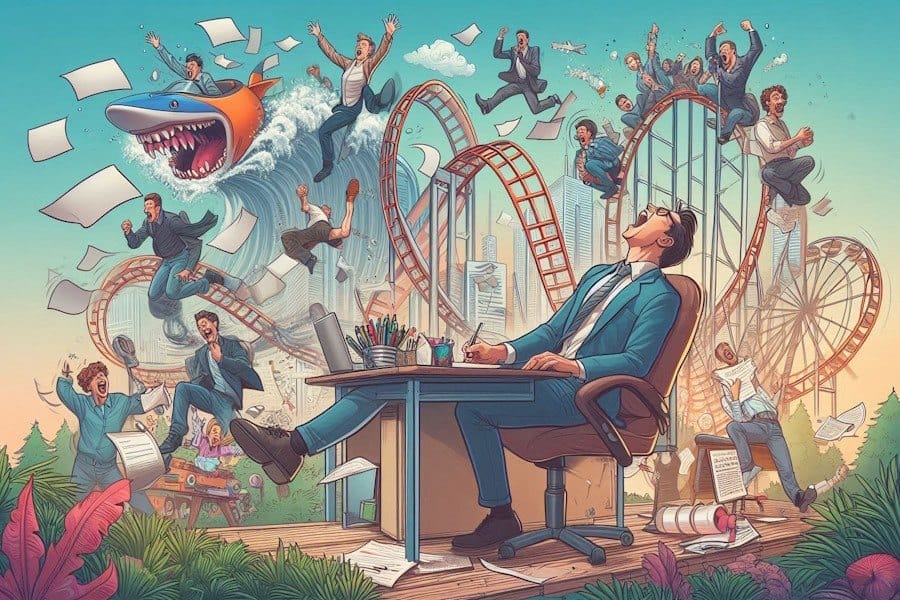

Owning a business is a roller coaster ride filled with exhilarating highs and stomach-churning lows. Throughout my diverse professional career, spanning multiple sectors, I've amassed a collection of stories that could make for an interesting sitcom—if only they weren't so painfully true. Back in the 1980s, my business partner and I embarked on an entrepreneurial journey armed with nothing but hard work, a sprinkle of luck, and the uncanny ability to be in the right place at the right time. We poured 100-hour weeks into our fledgling company; I even lived above the premises and went without a salary for the first six months. Ah, the glamour of entrepreneurship!

Despite our street smarts and previous encounters with some less-than-reputable operations, we learned the hard way that even the savviest can be blindsided. Just when we thought we had seen it all, our business was hit by one massive fraud and one procedural error within weeks of each other—completely independent events that left us reeling.

These experiences taught me invaluable lessons about the importance of procedures, paperwork, and setting firm financial boundaries, no matter how chummy you are with a client. Allow me to share these cautionary tales so you can avoid swallowing the same bitter pill.

Case 1: Procedural Oversight

We all hate them, but procedures are there for a reason, and this sad tale shows what happens when a single step is missed. Our business required that each client be insured. We were allowed to deal with clients aged 18 and over, as long as they had a valid driving license. My business partner had set up the insurance policy but had neglected one simple procedure: If we dealt with a client under 21, we had to send a copy of their driving license to the insurance company; otherwise, the insurance was not valid.

We had quite a market for younger clients, and so far, nothing had gone wrong—everything just ticked along. This is where fate can be both kind and cruel. One day, an 18-year-old man wanted to use our service. We didn't have our own vehicle available, but we did have a subcontracted one that we still had a few days left on before returning it. Everything looked good, and nothing more was said—until 20 minutes later, when I received a call from the police.

The young man had driven into the back of a stationary car. "Not a problem," I thought, "we have insurance!" A quick call to my business partner would settle this. How wrong I was. Within minutes, I was informed that because we had not sent the driver's license to the insurers, they would only cover the third-party damage. That meant we had to fix our own vehicle and continue paying for it for as long as it took to repair. It took three months to fix and cost thousands of pounds—all due to a missed procedure!

Lesson Learned: Procedures may seem like bureaucratic hurdles, but they exist to protect you. Skipping even one small step can lead to significant financial loss. Always ensure that all requirements are met, especially when it comes to insurance and legal obligations. Double-check, triple-check—your diligence can save you a fortune.

Case 2: The Long Con

We had a client who had been as reliable as a Swiss watch. For a year, they paid their monthly fees by cheque without a hitch. One day, they asked if they could switch to credit card payments. "No problem!" we said, appreciating the convenience (and thinking ourselves quite modern). We carried on for another nine months until I received a call from the credit card company. The cardholder was disputing nine months' worth of charges—yes, all of them.

Confidently, I faxed over our signed contract. Moments later, the credit card company informed me that the person who signed our contract wasn't the cardholder. Cue the sinking feeling. Since the actual cardholder hadn't authorized the charges, we were on the hook for refunding the entire amount—nearly £9,000 and the credit card company took it out immediately. In the 1980s, that was the kind of money that could make or break a small business.

Determined to sort this out, I drove to the client's impressive home and confronted him. His response? A nonchalant, "It's just business." He pointed out that everything he had—the car, the house, the fancy gadgets—was either rented or leased. If we sued him, we'd get nothing. He wasn't wrong.

Lesson Learned: No matter how long you've known a client or how trustworthy they seem, always ensure your paperwork is airtight and up to date. When changes occur—like switching payment methods—make sure all the proper authorizations are in place and that the right person signs on the dotted line. Trust, but verify!

Case 3: In Too Deep

This pitfall, fortunately, we avoided, but I've seen others fall headfirst into it. As your business grows, you'll encounter clients who request credit terms—sometimes up to 90 days. While offering credit can attract larger clients, handing out blanket credit limits is like leaving your front door open and hoping no one helps themselves.

Professional fraudsters are adept at exploiting this. They'll charm you, make partial payments, and gradually accumulate a significant debt. By the time you realize what's happening, you're in too deep. Cutting them off risks losing the owed money, but continuing the relationship digs the hole deeper. It's the classic dilemma: sunk cost fallacy meets professional con artistry.

Lesson Learned: Treat each client individually when it comes to extending credit. Do your homework—check their payment history and reputation. Set strict payment terms and stick to them. The moment a client starts missing payments or only pays partially, halt services immediately. It's better to take a smaller hit now than a catastrophic loss later. Remember, until the money is in your bank account, it doesn't exist.

Closing Thoughts

These experiences aren't just war stories to share over a pint; they're cautionary tales meant to save you from potential disaster. Paperwork isn't just bureaucratic red tape—it's your legal shield. Procedures aren't pesky obstacles—they're protective measures. Financial boundaries aren't just about protecting your bottom line—they're about ensuring your business survives and thrives.

Owning a business is no small feat. It's a journey filled with unexpected turns, but with vigilance and a healthy dose of skepticism, you can navigate the pitfalls that claim so many entrepreneurs. Don't let these bitter pills become part of your story.

Latest AI Business Articles

AI Questions and Answers section for A Bitter Pill to Swallow: The Perils of Owning a Business

Welcome to a new feature where you can interact with our AI called Jeannie. You can ask her anything relating to this article. If this feature is available, you should see a small genie lamp above this text. Click on the lamp to start a chat or view the following questions that Jeannie has answered relating to A Bitter Pill to Swallow: The Perils of Owning a Business.

Be the first to ask our Jeannie AI a question about this article

Look for the gold latern at the bottom right of your screen and click on it to enable Jeannie AI Chat.

Type: Article -> Category: AI Business