The Unintended Consequences of the Latest Labour Budget

Publish Date: Last Updated: 10th February 2025

Author: nick smith- With the help of CHATGPT

The recent Labour Budget has introduced several tax hikes that directly impact the business community. With three direct tax increases and an indirect one through Capital Gains Tax adjustments, businesses are facing new financial challenges. While employees won't pay more directly, Shadow Chancellor Rachel Reeves announced that employers’ National Insurance contributions will rise by 1.2 percentage points to 15% starting April 2025. Additionally, the secondary threshold for contributions will decrease from £9,100 to £5,000.

Reeves also confirmed an increase in the national living wage—the legal minimum for workers over 21—by 6.7% to £12.21 per hour, amounting to an extra £1,400 annually for a full-time worker. Capital Gains Tax is set to rise as well, with the lower rate increasing from 10% to 18% and the higher rate from 20% to 24%. However, the rates on the sale of second homes will remain unchanged. Notably, Reeves did not rule out the possibility of further tax hikes in the future.

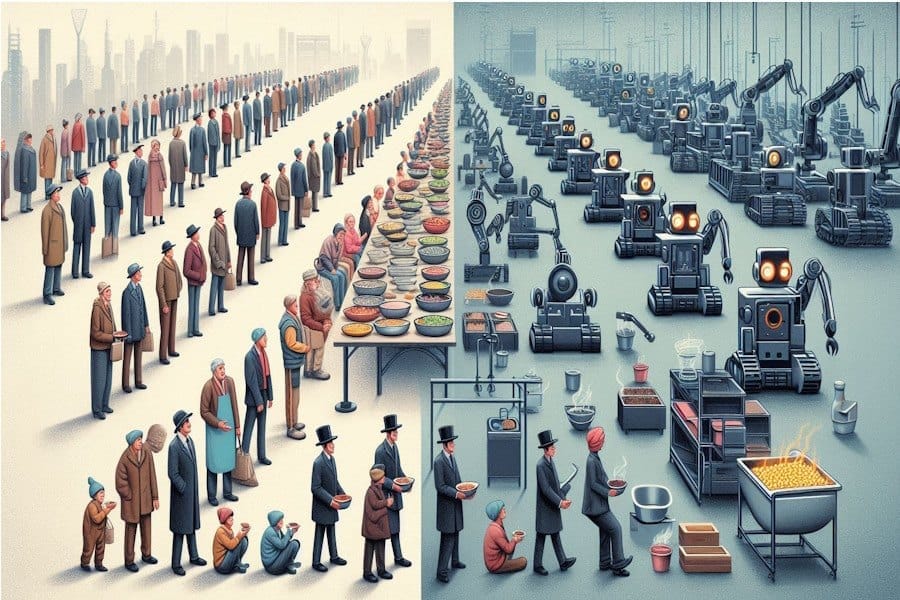

This article explores the unintended consequences of targeting businesses with additional labor taxes, particularly in an era where technological advancements are rapidly changing the economic landscape.

The Shift Towards Automation

Many businesses have historically found it more cost-effective to employ people rather than invest in expensive equipment and technology. However, the rapid advancements in Artificial Intelligence (AI) and robotics over the past five years have dramatically altered this calculation. Innovations such as self-driving vehicles and AI-powered accounting software with fraud detection are becoming increasingly practical and affordable—even for small businesses.

As labor costs rise due to increased wages and higher taxes, businesses may find that investing in automation and AI technologies becomes a more financially viable option. The associated costs of employing humans—such as National Insurance contributions, compliance with legal requirements, and providing benefits—add significant expenses. Automation offers a way to reduce these costs while increasing efficiency.

The Quiet Revolution in Business Operations

As employment costs and complexities increase, a quiet revolution is unfolding. Businesses are gradually realizing the long-term benefits of investing in automation and AI. While skeptics may point out that AI and machines are not infallible, they generally make fewer mistakes than humans and can operate without breaks, benefits, or compliance issues related to employment law.

Automation reduces the need for extensive human resources management, including dealing with mental health considerations, inclusivity policies, and other legal obligations that add to operational costs. By minimizing these burdens, businesses can improve profitability and efficiency.

Potential Economic Implications

Government policies that increase taxes on businesses need to consider the long-term consequences. While higher taxes might generate additional revenue in the short term, they could incentivize businesses to reduce their workforce in favor of automation. This shift could lead to higher unemployment rates, increasing the demand for social services and decreasing income tax revenues from employed individuals.

Moreover, if the labor force diminishes due to automation, the economy could experience a decrease in consumer spending, further impacting businesses and tax revenues. It is crucial for policymakers to balance tax strategies with initiatives that support both business growth and employment.

Addressing Systemic Issues

Instead of focusing solely on tax increases, governments could explore areas where substantial savings are possible without burdening businesses. For instance, it's estimated that over £20 billion is lost annually to fraud in the welfare system. Implementing advanced technologies like AI for fraud detection and improving management practices could significantly reduce these losses.

By tackling corruption and inefficiencies within existing systems, governments can improve fiscal health without stifling business growth or inadvertently accelerating job losses due to increased automation.

Trending AI News Articles

AI Questions and Answers section for The Unintended Consequences of the Latest Labour Budget

Welcome to a new feature where you can interact with our AI called Jeannie. You can ask her anything relating to this article. If this feature is available, you should see a small genie lamp above this text. Click on the lamp to start a chat or view the following questions that Jeannie has answered relating to The Unintended Consequences of the Latest Labour Budget.

Be the first to ask our Jeannie AI a question about this article

Look for the gold latern at the bottom right of your screen and click on it to enable Jeannie AI Chat.