UK Steel

False Hope, Chinese Control, and the Folly of Free Trade

Publish Date: Last Updated: 16th May 2025

Author: nick smith- With the help of GROK3

On April 12, 2025, the UK government scrambled to save British Steel’s Scunthorpe plant, passing emergency legislation to seize control from its Chinese owner, Jingye, which had halted raw material orders and threatened to shut down the nation’s last blast furnaces. This dramatic intervention, aimed at protecting 2,700 jobs and 37,000 more in supply chains, underscores steel’s vital role in national security and infrastructure. Yet, it masks a deeper crisis: the UK’s steel industry, producing just 4 million metric tons against 68% imported consumption, is buckling under global overcapacity, led by China’s 1 billion-ton output. While the government secures emergency coal and ore from the US and Australia, it pours subsidies into a Chinese-owned firm without confronting the root issue—unfair competition from state-backed Chinese steel. Contrast this with US President Donald Trump’s 25% tariffs on UK steel and 45% on Chinese imports, a protectionist stance to shield domestic industry. By failing to adopt similar tariffs, the UK offers false hope to steelworkers, risking a costly folly as nationalization looms and taxpayers bear the burden.

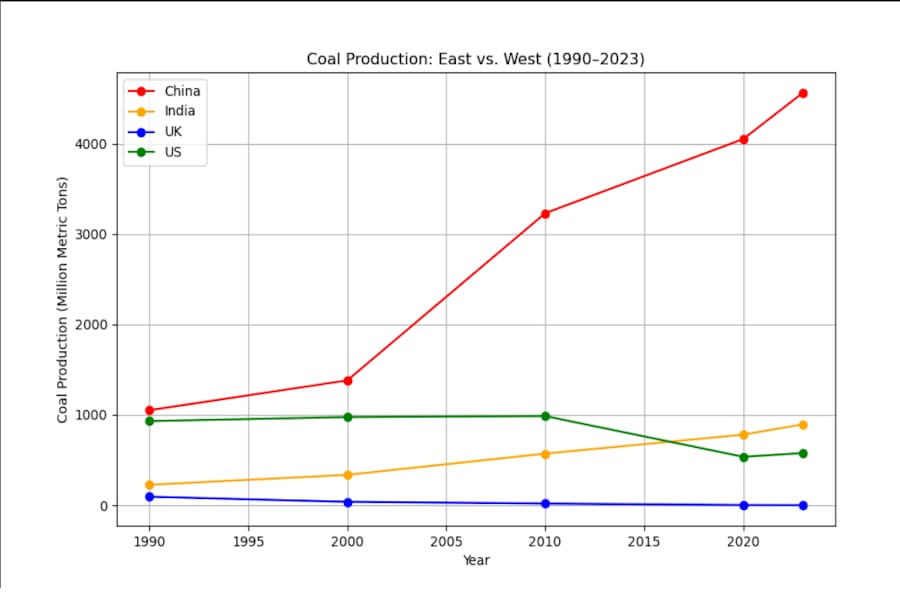

Coal Production (East vs. West)

The Scunthorpe Crisis: A Chinese Conflict

Jingye’s decision to cancel orders for coking coal and iron ore, while attempting to sell existing supplies, pushed Scunthorpe to the brink, threatening to cool its blast furnaces—a “complex, costly nightmare” to restart. The UK government responded decisively, passing laws to direct British Steel’s operations, secure raw materials, and appoint new leadership, with shipments arriving from the US and Australia by April 15. Business Secretary Jonathan Reynolds called Jingye’s actions “bad faith,” noting the firm rejected subsidies to keep furnaces running, prompting speculation of sabotage, later dismissed by officials. Yet, the government’s approach—subsidizing a Chinese-owned company losing £700,000 daily—ignores the elephant in the room: China’s state-backed steel industry fuels a 543-million-ton global overcapacity, depressing prices and squeezing Western producers. Nationalization, now “likely,” risks billions in costs without addressing this imbalance, offering temporary job security but no path to sustainability.

Global Free Trade: A Flawed Fantasy

The Scunthorpe crisis exposes the myth of global free trade. China’s steel, produced with cheap coal, suppressed wages, and minimal emissions oversight, undercuts UK producers facing electricity costs 40% higher than France’s and carbon taxes under the Emissions Trading Scheme. Jingye’s ability to threaten closure while negotiating bailouts shows how foreign owners exploit open markets. True free trade demands global rules on subsidies, wages, and emissions—nonexistent in a system where China’s mercantilist tactics go unchecked. The UK’s 17% surge in steel imports in 2025 reflects its vulnerability, worsened by expiring safeguards in 2026 and a delayed Carbon Border Adjustment Mechanism until 2027. Reynolds acknowledged China’s “over-production and dumping,” yet the government avoids tariffs, leaving steelworkers exposed to a flood of cheap imports diverted from the US market.

The West’s Industrial Erosion

The UK’s steel decline mirrors a broader Western failure: prioritizing services and finance over manufacturing. From 20 million metric tons in the 1970s to 4 million today, the UK’s steel industry has withered, leaving it reliant on imports prone to global shocks, like China’s 2021 export cuts that spiked prices. The government’s claim that steel is crucial for building 1.5 million homes highlights manufacturing’s strategic role, yet past policies—handing billions to foreign owners like Jingye and Tata without equity—have yielded job cuts and closures. The US lost 5 million manufacturing jobs from 1997 to 2024, and the UK’s industrial base faces similar erosion without bold action. Trump’s tariffs, while painful for UK exports (£388 million in 2023), prioritize domestic security—a lesson the UK ignores at its peril.

Tariffs and Trade Alliances: A Necessary Shift

Trump’s 25% tariffs on global steel (45% on Chinese) aim to shield US producers from overcapacity, while the UK dithers, hoping for a US trade deal. Without reciprocal tariffs, the UK faces trade diversion as Chinese steel floods its markets, with safeguards expiring soon. The EU’s counter-tariffs on $28 billion of US goods show the power of collective action, yet the UK’s “pragmatic” stance leaves it exposed. To survive, the UK must impose tariffs on Chinese steel and forge trade alliances with fair-trading nations like the EU or Canada, ensuring compliance with labor and environmental standards. Such measures could protect jobs and incentivize private investment, reducing reliance on nationalization’s fiscal burden.

Environmental Contradictions: The Coal Paradox

The government’s net-zero push creates a glaring hypocrisy: while closing domestic coal mines, it imports coking coal and iron ore from Australia and the US, shipped across thousands of miles. The carbon emissions from transport and extraction likely exceed those from limited, regulated domestic coal production, which could have supplied steelmaking at lower cost and environmental impact. The Emissions Trading Scheme penalizes UK producers, while Chinese steel faces minimal carbon costs, tilting competition further. The Scunthorpe rescue, reliant on global supply chains, perpetuates this “carbon washing,” undermining both the industry and the climate goals it claims to uphold.

UK Steel News on YouTube

Minister refuses to rule out future China involvement with British Steel

YouTube Channel: Sky News

UK Seizes Chinese Business

YouTube Channel: Joe Blogs

“This Isn’t Going To End Well For Taxpayers” | China Threatens To Pull UK Investment Over Steel Row

YouTube Channel: TalkTV

Raw materials to keep British Steel furnaces burning arrive in UK | ITV News

YouTube Channel: ITV News

‘Laughing Stock’ | UK Importing Coal From Japan For BRITISH Steel Furnace

YouTube Channel: TalkTV

“Why Did We Sell It To The Chinese?!” | Government Takes Control Of British Steel Scunthorpe

YouTube Channel: TalkTV

“We’re Living In A World Of Insanity” | Reform UK’s Richard Tice On Chinese ‘Sabotage’

YouTube Channel: TalkTV

Reynolds declines to guarantee the Government can keep Scunthorpe blast furnaces going

YouTube Channel: The London Standard

Conclusion: Courage or Collapse

The UK government’s rescue of Scunthorpe averts immediate disaster, but it’s a fragile lifeline for an industry hemorrhaging under global pressures. Subsidizing a Chinese-owned firm while ignoring China’s 543-million-ton steel overcapacity offers false hope, leaving steelworkers and taxpayers to face a potential collapse. Since 2020, the UK has funneled at least £800 million to foreign-owned steelmakers like Jingye and Tata, with 75–87.5% (£600–700 million) leaving the country for imported raw materials, management fees, and potential dividends. The UK steel industry requires 2.5–3 million metric tons of coking coal annually, nearly all imported from Australia and the US, generating a carbon footprint of 8.1 million metric tons of CO2—equivalent to the emissions of 2.7 million UK citizens. This reliance on imports, while domestic coal lies untapped, is neither green nor economical. Reopening a few tightly regulated coal mines is essential for profitability and lower emissions, as global transport emissions dwarf those from local production. The shift to electric arc furnaces, heralded as a green solution, cannot produce the virgin, high-grade steel needed for critical infrastructure, and the UK’s renewable energy sector—already strained—cannot support an expanded steel industry without spiking domestic electricity prices, burdening households. Meanwhile, coal production in the East soars—China produced 4.56 billion metric tons in 2023, India 893 million—while the West’s output collapses, with UK production at a mere 107,000 metric tons. To survive, the UK must impose tariffs on Chinese steel, forge trade alliances with fair-trading nations, and embrace pragmatic coal use. Without this courage—tariffs, alliances, and domestic coal—the UK steel industry will limp on as a costly relic, its collapse inevitable, leaving communities shattered and taxpayers footing the bill.

Recent AI Driven News Articles

AI Questions and Answers section for UK Steel: False Hope, Chinese Control, and the Folly of Free Trade

Welcome to a new feature where you can interact with our AI called Jeannie. You can ask her anything relating to this article. If this feature is available, you should see a small genie lamp above this text. Click on the lamp to start a chat or view the following questions that Jeannie has answered relating to UK Steel: False Hope, Chinese Control, and the Folly of Free Trade.

Be the first to ask our Jeannie AI a question about this article

Look for the gold latern at the bottom right of your screen and click on it to enable Jeannie AI Chat.